Kicking off with the 40 30 30 rule, this simple budgeting method offers a straightforward approach to managing your finances. It divides your income into three categories: needs (40%), wants (30%), and savings/debt reduction (30%). This structured approach can be incredibly helpful for anyone looking to gain control over their spending and build a healthier financial future. We’ll delve into its benefits, drawbacks, and variations, ultimately empowering you to personalize this rule for maximum effectiveness.

The 40 30 30 rule, in its simplest form, is a budgeting method that allocates a fixed percentage of your income to different spending categories. This allocation is designed to help you prioritize essential needs, satisfy desires, and cultivate financial stability. The key is finding the balance that works for your individual circumstances. This post explores the core concepts, its practical applications, and how you can adapt it to your specific needs.

Defining the 40-30-30 Rule

The 40-30-30 rule is a popular budgeting method that helps individuals manage their finances effectively. It’s a straightforward approach that divides your after-tax income into three categories, ensuring you allocate resources to essential needs, desired wants, and future financial goals. This structure provides a clear framework for prioritizing spending and saving.This rule simplifies financial management by categorizing expenses, fostering a sense of control over your finances.

By understanding how to allocate your income, you can make informed decisions about spending and saving, which leads to better financial stability and achievement of your financial objectives.

Ever heard of the 40 30 30 rule? It’s a popular budgeting method, but Kim Hastreiter’s whirlwind New York City life, documented in her book kim hastreiter stuff a new york life of cultural chaos , shows how it can be tricky to stick to in a bustling city. Balancing cultural experiences with financial discipline is definitely a challenge, and the rule’s practical application in such a dynamic environment requires adaptability and careful consideration.

Still, the basic concept of allocating funds remains a powerful tool for managing your finances.

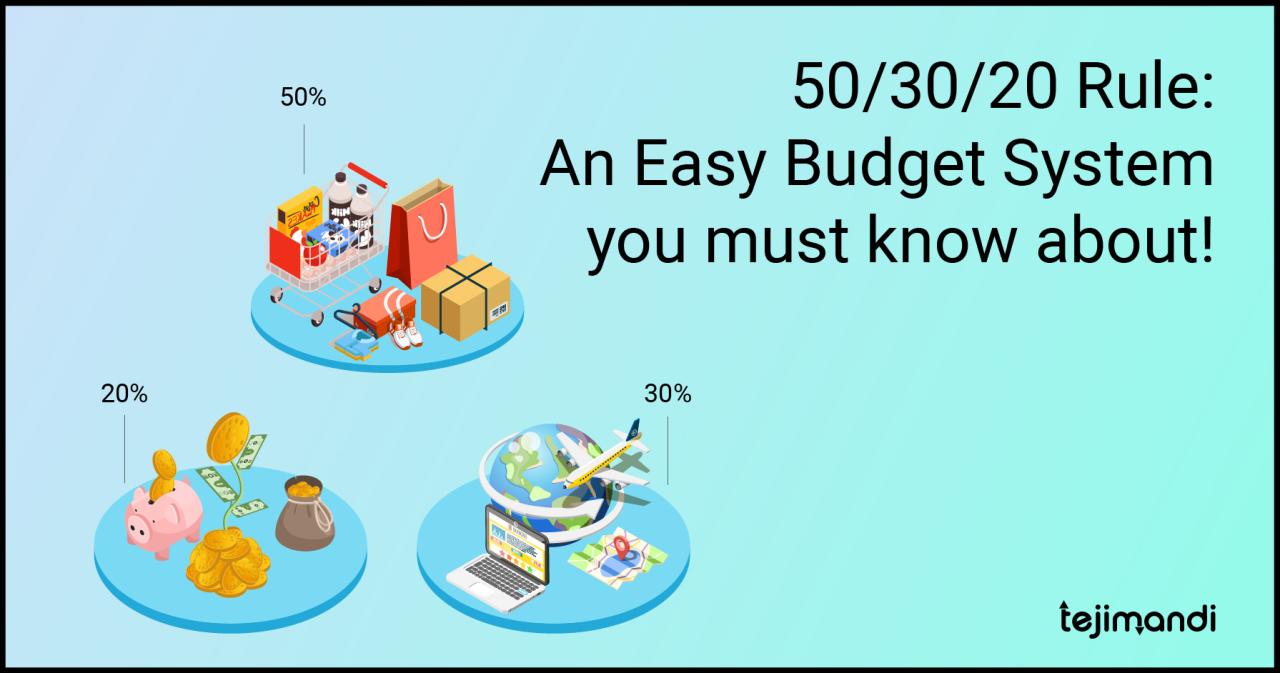

Categories of the 40-30-30 Rule

This budgeting method categorizes expenses into three distinct areas: needs, wants, and savings/debt reduction. Understanding each category is key to successful implementation of this financial management technique.

| Component | Percentage | Description | Example |

|---|---|---|---|

| Needs | 40% | These are the essential expenses required for basic living. | Rent, utilities, groceries, transportation, and basic healthcare. |

| Wants | 30% | These are expenses for non-essential items and experiences. | Dining out, entertainment, shopping for non-essential items, and subscriptions. |

| Savings/Debt Reduction | 30% | This category covers financial goals such as building an emergency fund, paying off debt, and saving for major purchases or future investments. | Retirement savings, debt repayments, and contributions to a college fund. |

Applying the 40-30-30 Rule

The 40-30-30 rule offers a structured approach to spending and saving. It encourages individuals to prioritize needs, allocate a portion for desired wants, and set aside a significant amount for future financial security. By consistently adhering to this rule, you can achieve your financial goals. A key benefit is that it fosters a disciplined approach to managing money, leading to long-term financial well-being.

Advantages of the 40-30-30 Rule: 40 30 30 Rule

The 40-30-30 rule, a budgeting strategy, divides your income into three categories: 40% for needs, 30% for wants, and 30% for savings and debt repayment. This straightforward approach can be surprisingly effective for establishing financial stability and achieving long-term goals. Understanding its potential benefits and how it impacts financial well-being is crucial for successful implementation.This rule simplifies the often complex world of personal finance by offering a clear structure for allocating resources.

It fosters a proactive approach to managing finances, allowing individuals to consciously prioritize their spending habits and financial objectives.

Potential Benefits for Financial Well-being

The 40-30-30 rule offers several key advantages for enhancing financial well-being. It promotes financial discipline by clearly defining spending categories, which encourages a more intentional approach to budgeting. This structured approach fosters a stronger understanding of where money is going, potentially preventing impulsive spending and fostering a more mindful relationship with finances.

Practicality and Ease of Application

The 40-30-30 rule’s appeal lies in its simplicity. It doesn’t require complex calculations or intricate financial software. The straightforward allocation percentages make it easily adaptable to various income levels and lifestyles. This simplicity is a significant advantage for individuals new to budgeting or those seeking a streamlined approach.

Scenarios Where the Rule Might Prove Beneficial

This rule can be beneficial in numerous scenarios, providing a structured approach to manage personal finances. For instance, individuals transitioning to a new job or income level can use this rule to adapt their spending habits quickly and effectively. It’s also ideal for those seeking to build an emergency fund or save for significant purchases, like a house or a car.

- Debt Management: The 30% allocated to savings and debt repayment can be instrumental in tackling high-interest debts. By systematically allocating a portion of income to debt reduction, individuals can work towards debt freedom more effectively.

- Building an Emergency Fund: A dedicated portion of income earmarked for savings helps build a financial safety net against unexpected expenses. This cushion can ease anxieties and offer a sense of security in times of hardship.

- Financial Goal Achievement: The 40-30-30 rule provides a framework for achieving specific financial goals. By systematically saving for a down payment on a house or other significant purchases, the rule offers a clear roadmap towards achieving these objectives.

- Improving Spending Habits: The rule can assist in identifying areas where spending is excessive. By understanding the breakdown of income allocation, individuals can pinpoint areas where they might want to cut back on unnecessary expenses and redirect those funds to savings or debt reduction.

Disadvantages of the 40-30-30 Rule

The 40-30-30 rule, while offering a simple and straightforward approach to budgeting, has inherent limitations. Its rigid structure can be problematic for individuals with unique financial situations or those experiencing significant life changes. Understanding these drawbacks is crucial for determining if this budgeting method is suitable for your personal circumstances.The 40-30-30 rule, with its fixed allocation percentages, can prove inflexible in adapting to fluctuating expenses or unexpected financial demands.

This rigidity can lead to difficulty in maintaining financial stability during periods of high costs or unforeseen emergencies.

Limitations of Fixed Allocation

The 40-30-30 rule’s primary limitation stems from its fixed allocation. It doesn’t account for varying needs and circumstances. For instance, someone with substantial student loan payments or high medical expenses might find the 30% allocation for needs insufficient. Similarly, someone saving for a significant purchase, such as a down payment on a house, might find the 40% allocation for savings restrictive.

These fixed percentages fail to consider individual financial situations and goals.

Inflexibility in Unexpected Expenses

Unexpected expenses, such as car repairs, medical bills, or appliance malfunctions, can quickly deplete a budget. The 40-30-30 rule, with its rigid allocations, doesn’t accommodate such contingencies. If an unexpected expense arises, it might necessitate borrowing money or compromising on essential needs, potentially jeopardizing financial well-being.

Examples of Misalignment with Specific Financial Situations

Consider a young professional with a substantial student loan debt. The 40% allocated for savings might be insufficient to meet the loan repayment obligations, leaving them with little financial breathing room. Conversely, a family with young children and high childcare costs might find the 30% allocation for needs insufficient to cover expenses. These examples demonstrate how the 40-30-30 rule can be unsuitable for diverse financial situations.

Comparison with Alternative Budgeting Methods, 40 30 30 rule

| Feature | 40-30-30 Rule | Zero-Based Budgeting |

|---|---|---|

| Flexibility | Low | High |

| Adaptability | Low | High |

| Expense Tracking | Minimal | Extensive |

Zero-based budgeting, in contrast, meticulously tracks every expense, allowing for adjustments and adaptability based on actual spending patterns. It provides a far more nuanced and personalized approach to budgeting compared to the rigid allocation of the 40-30-30 rule. The 40-30-30 rule’s simplicity masks its limitations in handling the variability of real-world finances.

Variations and Adaptations of the 40-30-30 Rule

The 40-30-30 rule, while a helpful starting point for budgeting, isn’t a one-size-fits-all solution. Individual circumstances, financial goals, and spending habits necessitate adjustments. This section delves into various adaptations, showing how to personalize the rule for maximum effectiveness. By tailoring the allocation percentages, you can align the rule with your unique financial situation, whether you’re tackling high debt, managing substantial expenses, or aiming for specific financial objectives.While the basic 40-30-30 structure provides a framework, it’s crucial to understand that flexibility is key.

The 40 30 30 rule is all about mindful eating, right? Well, if you’re looking to incorporate liquid protein into your healthy eating plan, understanding how it fits into your macro goals is key. A dietitian’s insights into the role of liquid protein in your diet can help you understand the optimal portion sizes and nutritional value, which is crucial when using it as part of a balanced meal plan.

Check out this dietitian guide to liquid protein for a comprehensive look at different types of liquid protein and their potential benefits. Ultimately, the 40 30 30 rule, when combined with the right nutritional guidance, will help you eat healthy and feel your best.

Adjustments can significantly improve the rule’s practical application. This flexibility allows you to create a personalized financial strategy that’s both effective and sustainable.

Modifying the Rule for High Debt

High debt necessitates a more aggressive approach to debt repayment. Instead of strictly adhering to the 40-30-30 split, a larger portion of your budget should be allocated to debt reduction. Consider reallocating a portion of the 30% for necessities and the 40% for wants to the debt repayment category. This may require reducing spending on non-essential items and prioritizing debt reduction.

The 40 30 30 rule is all about budgeting, right? Well, when you’re planning a trip to stunning destinations like the lush rainforests and white-sand beaches of Costa Rica, it’s even more crucial. Thinking about allocating 40% of your budget to experiences, 30% to accommodation, and 30% to activities, especially when considering best places to visit in Costa Rica , will help you make the most of your time and money.

It’s a simple formula for maximizing your travel experience, even on a limited budget.

Adapting for Large Expenses

Significant expenses, like large purchases or unexpected events, require a different approach. Instead of rigidly adhering to the 40-30-30 rule, you may need to temporarily adjust the allocations. For example, if you need to save for a down payment on a house, you might temporarily increase the savings portion (the 40%) to accommodate the higher expense.

Creating a Personalized Version

Developing a personalized version of the 40-30-30 rule involves several steps:

- Assess your income and expenses: Track your income and expenses for a month or two to understand your spending habits. Identify areas where you can cut back or redirect funds.

- Prioritize your financial goals: Determine your short-term and long-term financial goals. This could include paying off debt, saving for a down payment, or building an emergency fund. Prioritize these goals to adjust the allocation of your budget.

- Identify areas for potential savings: Examine your spending habits. Look for areas where you can reduce unnecessary spending, like subscription services, dining out, or entertainment. Look for subscriptions you might not be using or have forgotten about.

- Experiment with different allocations: Start with the 40-30-30 rule as a baseline and adjust the percentages based on your financial situation and goals. Trial and error is key in finding what works best for you.

- Review and adjust regularly: Your financial situation may change over time. Review your budget and spending habits regularly, adjusting your allocations as needed to maintain alignment with your goals.

Example Modifications

| Financial Situation | Modified Allocation |

|---|---|

| Student with high tuition costs | 45% Savings (for tuition and living expenses), 30% Necessities, 25% Wants |

| Young professional with high debt | 50% Debt Repayment, 35% Necessities, 15% Wants |

| Family saving for a large purchase | 55% Savings, 30% Necessities, 15% Wants |

Practical Applications of the 40-30-30 Rule

The 40-30-30 rule, while a helpful framework, requires practical application to yield results. This section dives into how to effectively implement this budgeting strategy, monitor progress, and leverage available tools. By understanding the practical steps, you can successfully navigate the complexities of personal finance and achieve your financial goals.Implementing the 40-30-30 rule involves a structured approach to allocate your income.

This process is crucial for establishing financial discipline and tracking progress. The key is to consistently apply the rule to your income each month.

Step-by-Step Implementation Guide

A methodical approach to implementing the 40-30-30 rule ensures you consistently allocate your funds according to the defined percentages. This structured approach fosters financial discipline and allows you to track your progress effectively.

- Determine your monthly net income. This is the amount of money you receive after all deductions, such as taxes and other withholdings. This is your starting point for allocating funds. Subtract all your necessary expenses to arrive at your net income.

- Categorize your expenses. Divide your expenses into three categories: needs (40%), wants (30%), and savings/debt repayment (30%). This crucial step allows you to visualize where your money goes and identify areas for potential savings.

- Allocate funds to each category. Multiply your net income by the percentages (40%, 30%, and 30%) to determine the exact amount allocated to each category. This calculation provides a clear budget for each spending area.

- Track your spending meticulously. Use a budgeting app or spreadsheet to record every expense, ensuring you stay within your allocated budget. This detailed tracking allows for adjustments and ensures accountability.

- Review and adjust your budget regularly. Monthly reviews help you identify areas where you’re overspending or underspending. Regular adjustments keep your budget aligned with your financial goals and changing circumstances.

Expense Tracking and Monitoring Progress

Tracking your expenses is crucial for understanding where your money is going and for making adjustments to your budget. This detailed monitoring enables you to identify spending patterns and areas for improvement.

- Use a budgeting app or spreadsheet. Dedicated budgeting apps or spreadsheets provide tools for recording transactions, categorizing expenses, and generating reports. These tools are specifically designed to facilitate tracking and analysis.

- Track your spending for a month. This period provides a clear picture of your spending habits and allows for accurate assessments of your spending patterns. This month-long tracking offers valuable insight into your spending behavior.

- Analyze your spending data. Look for areas where you’re consistently overspending or exceeding your allocated budget. This analysis is crucial for identifying spending patterns that can be adjusted or minimized.

- Compare your actual spending to your budget. This comparison highlights discrepancies between your planned expenses and your actual spending. It facilitates adjustments and better financial planning.

Budgeting Software Examples

Several budgeting software options can aid in implementing and tracking the 40-30-30 rule. These tools streamline the process of budgeting and provide insights into spending patterns.

- Mint offers a comprehensive overview of your finances, including budgeting tools and expense tracking. It provides a visual representation of your spending habits.

- Personal Capital combines budgeting with investment tracking and financial planning features. It helps you visualize your financial health comprehensively.

- YNAB (You Need a Budget) is designed to help you budget effectively and prioritize your financial goals. It provides tools for setting goals and tracking progress.

Budgeting Tips for the 40-30-30 Rule

These tips enhance your effectiveness when implementing the 40-30-30 rule. They focus on building financial discipline and achieving your financial goals.

- Create a detailed budget. A detailed budget is essential for ensuring that your spending aligns with your financial goals. It allows for a clear understanding of your financial position.

- Automate your savings. Setting up automatic transfers to your savings account can help ensure consistent savings. This automated process eliminates the need for manual transfers, ensuring consistency.

- Cook at home more often. Eating out less can significantly reduce food costs. This reduces spending and increases savings. This is a valuable way to control spending and boost savings.

- Shop around for better deals. Comparing prices and searching for discounts can help you save money on purchases. This practice ensures you’re getting the best value for your money.

Illustrative Examples

The 40-30-30 rule, while a simple guideline, can be powerfully effective when applied thoughtfully. Real-world examples showcase how this budgeting method can empower individuals to achieve financial goals and manage their spending habits. These examples demonstrate the adaptability and practicality of the rule.Successful implementation relies on realistic adjustments and a commitment to sticking to the plan, as seen in the following case studies.

Understanding how individuals have successfully used this rule provides valuable insights.

Real-Life Scenarios

The 40-30-30 rule isn’t a one-size-fits-all solution. Its effectiveness hinges on understanding your financial situation and adjusting the percentages accordingly. For example, someone with substantial student loan debt might need to allocate a larger portion of their income to debt repayment, potentially adjusting the percentages to 50-20-30, prioritizing debt reduction.

- Sarah, a young professional, initially allocated 40% of her income to needs, 30% to wants, and 30% to savings. Over time, she realized that her housing costs were higher than anticipated. She adjusted her 40% needs category to reflect her actual expenses. This allowed her to maintain her savings goal while adjusting to her specific circumstances.

This example highlights the importance of regular review and adjustment.

- Mark, a stay-at-home parent, found the 40-30-30 rule helpful in managing his family’s budget. He allocated 40% of his income to essential expenses, including childcare and groceries. He used the remaining percentages to cover household needs and occasional outings. His successful implementation underscores the rule’s applicability across various life stages.

Successful Implementation Stories

Numerous individuals have reported positive outcomes from using the 40-30-30 rule. These success stories underscore the flexibility and effectiveness of this budgeting method.

- A recent graduate, Emily, used the 40-30-30 rule to pay off her student loans. She allocated 50% of her income to needs, 20% to wants, and 30% to savings and debt repayment. This strategy, while adjusting the original percentages, allowed her to achieve her financial goals faster than expected. Her success illustrates how the rule can be tailored to specific financial objectives.

- A mid-career professional, David, used the 40-30-30 rule to build an emergency fund. He allocated 40% of his income to needs, 30% to wants, and 30% to savings. Over time, he diligently contributed to his emergency fund, building a safety net against unforeseen circumstances. This example showcases the rule’s utility in creating a financial safety net.

Financial Goal Achievement

The 40-30-30 rule can be a powerful tool for achieving specific financial goals. The method enables focused saving and expense management.

- By allocating a portion of income to savings, individuals can build an emergency fund. This fund can provide a financial cushion during unexpected events, such as job loss or medical emergencies. The rule’s effectiveness is evident in scenarios where individuals prioritize building financial security.

- The rule facilitates debt repayment. By allocating a portion of income to debt repayment, individuals can reduce their overall financial burden and improve their credit score. This targeted allocation allows for more effective management of debt, and ultimately, better financial health.

Visual Representation (Infographic)

Imagine a circle divided into three sections. The largest section, representing 40%, is labeled “Needs.” The middle section, representing 30%, is labeled “Wants.” The smallest section, representing 30%, is labeled “Savings.” This visual representation clearly depicts the allocation of income according to the 40-30-30 rule. This simple infographic helps to visualize the budgeting strategy.

Concluding Remarks

In conclusion, the 40 30 30 rule, while a helpful starting point, should be viewed as a flexible framework, not a rigid formula. Adapting it to your specific financial situation is crucial for success. Remember, the goal isn’t just about allocating funds; it’s about creating a sustainable financial strategy that empowers you to achieve your long-term goals. Experiment with different approaches and find what works best for you.